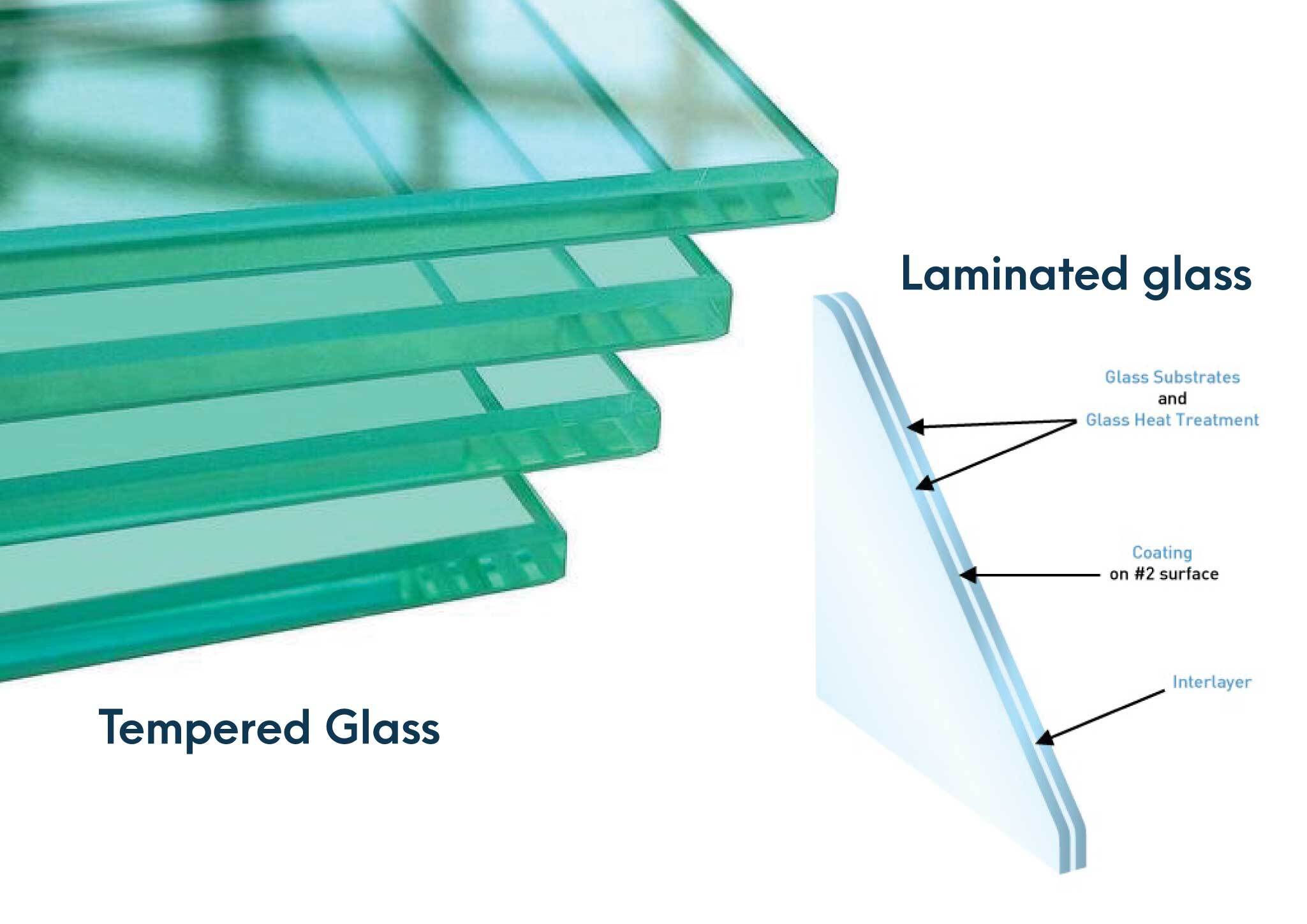

BLUE WHALE is equipped with state-of-the-art Windows & Doors production unit, with imported European plant and machinery.

BLUE WHALE works with international windows & doors component manufacturers to bring you a wide range of Engineered System Windows & Doors solutions.

Overcoming the obvious disadvantages of its previous counterparts, Blue Whale Upvc & Aluminium System Windows & Doors is here to stay. Aesthetic, Builders’ choice, Cost-effective, Termite & Borer Proof, Fire Proof, Sound Proof, Dust Proof, Weather Proof, Rain Proof, Durable, Energy Efficient, so on and so forth, it comes with a multitude of advantages. What’s more, with its ‘Fit and Fix’ nature, you no longer have to deal with carpentry hassles!

Upvc System Windows & Doors

[trustindex no-registration=google]